Chargeback Alerts

What Are Chargebacks?

A chargeback occurs when a cardholder disputes a transaction with their credit or debit card issuer, requesting a reversal of the payment. Originally created as a consumer protection mechanism, chargebacks now also stem from:

-

Fraudulent Transactions: Unauthorized card use

-

Customer Dissatisfaction: Disputes over product or service quality

-

Billing Errors: Duplicate or incorrect charges

-

Friendly Fraud: Customers disputing valid charges, whether mistakenly or intentionally

Why Chargebacks Matter

Chargebacks can cause substantial harm to a business, including:

-

Financial Losses: Forfeiture of transaction revenue, chargeback fees ($20–$100), inventory, shipping, and labor

-

Increased Processing Costs: Higher fees or reserves due to elevated chargeback ratios

-

Reputational Risk: Negative merchant standing with processors and card networks

-

Account Termination: Excessive chargebacks (over 0.9–1.0% of volume) may result in losing processing privileges

Chargeback Alerts: A Proactive Defense

Chargeback Alerts notify merchants of disputes in real time—before they are formally filed as chargebacks. This gives merchants a critical window to intervene, often allowing them to issue a refund or resolve the issue with the customer directly.

How Chargeback Alerts Work

-

Dispute Detection

Alerts are triggered the moment a dispute is initiated by the issuer, based on your billing descriptor, not your MID. -

Instant Notification

You receive an alert in your Bankful dashboard with dispute details (when available). -

Resolution Window

You typically have 24–72 hours to resolve the issue or issue a refund before it becomes a formal chargeback. -

Dispute Prevention

If resolved in time, the chargeback is avoided—protecting your chargeback ratio and processing account.

⚠️ Important Limitations & Merchant Responsibilities

To ensure transparency and reduce confusion, please note the following:

-

Alerts are generated based on the billing descriptor, not the MID. This means:

-

Alerts may trigger for any MID that shares your enrolled descriptor, even if it’s not processing through Bankful.

-

If the transaction did not occur within Bankful, the alert will still populate.

-

-

In cases where you believe an alert was triggered incorrectly or is missing critical information, you may submit a request for review or rebuttal by submitting a support ticket. Please include:

-

The date and alert ID (if available)

-

A summary of the issue

-

Any supporting documents or references (e.g., processor details)

-

Benefits of Chargeback Alerts

-

Prevents formal chargebacks before they are filed

-

Reduces dispute-related losses

-

Maintains a low chargeback ratio

-

Protects processor relationships and approval rates

-

Builds trust with customers through proactive resolution

How to Activate Chargeback Alerts

- Login to Bankful

- Click on Chargeback Alerts on the menu to the left of your dashboard

- Click “Activate Chargeback Alerts”

- Click on “+ Add additional MID”

- Input your “Merchant ID Number” and your listed processing bank’s “Descriptor”

- This information needs to be precise in order for Chargeback Alerts to function properly

- Please reach out to your processing bank or agent to ensure this information is correct

- You may also contact us at support@bankful.com

How to Utilize Chargeback Alerts

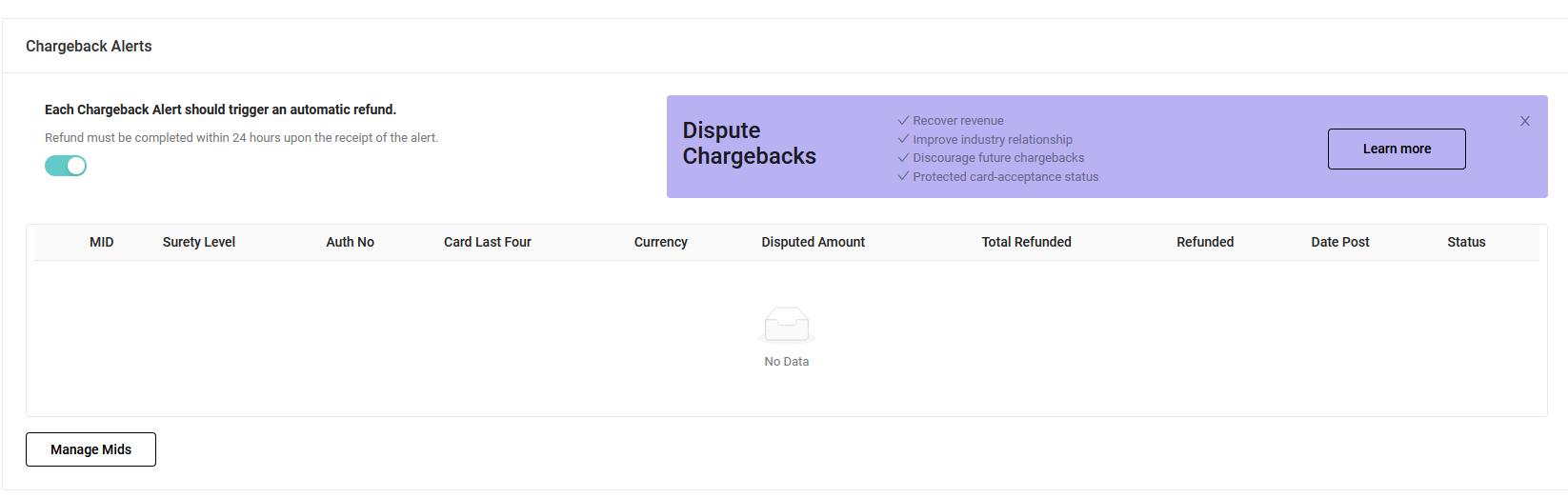

- Once your request is approved, your Chargeback Alert page will look like this:

- You can engage the top toggle button to enable automatic refunds for your chargebacks

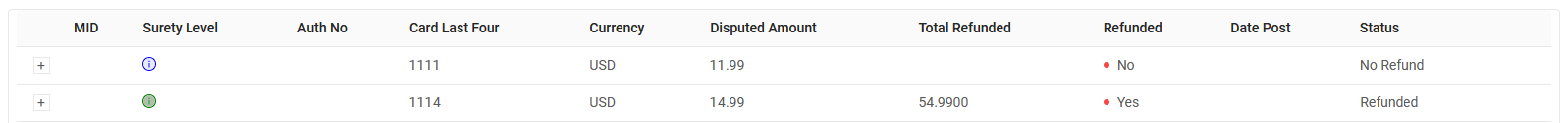

- If you incur any chargebacks, they will appear as in the example below

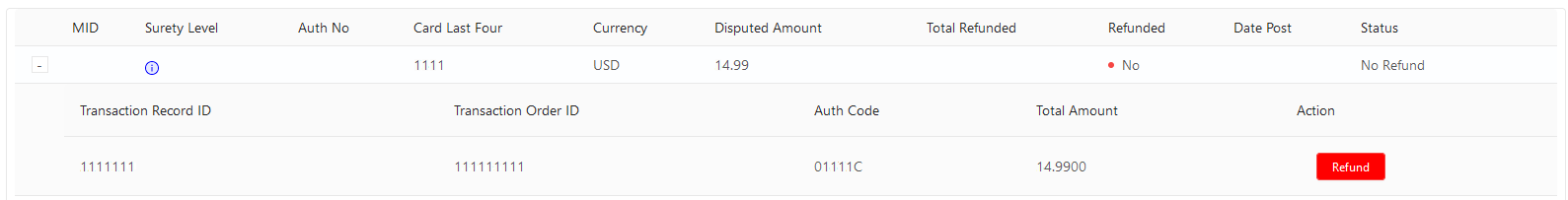

- By clicking on the + sign at the left of a chargeback you can expand the details

- You can also to choose to refund from here

11.20.2024