Understanding ARNs and how to obtain them for Rapid Dispute Resolution (RDR)

What is an ARN?

An Acquirer Reference Number (ARN) is a unique identifier assigned to a credit card transaction. It allows merchants, issuers, acquirers, and cardholders to track a transaction as it moves through the payment network. The ARN is crucial for tracing disputes, chargebacks, and other transaction-related issues.

Each ARN is linked to a specific transaction and provides a reference for retrieving detailed information about that payment, making it an essential tool in dispute resolution processes.

Why Are ARNs Important for Rapid Dispute Resolution?

Rapid Dispute Resolution (RDR) is a proactive tool that enables merchants to resolve disputes quickly, often before they escalate into chargebacks. By leveraging ARNs, merchants can:

- Identify disputed transactions: Track specific payments flagged for potential disputes.

- Enable faster resolution: Provide detailed transaction data to processors, issuers, or third-party RDR services to resolve disputes efficiently.

- Improve customer satisfaction: Proactively addressing disputes minimizes customer frustration and fosters trust.

To set up and effectively utilize RDR, merchants need access to ARNs for their transactions.

How to Obtain ARNs from Your Processor

Step 1: Contact Your Processor

Reach out to your payment processor or acquiring bank and request three Visa ARNs from your recent transactions (must be within 30 days). Most processors maintain detailed transaction logs that include ARNs. Common ways to contact your processor include:

- Customer support portals: Log in to your processor’s merchant dashboard and submit a support ticket.

- Email or phone support: Use the designated contact channels provided by your processor.

- Bankful Support Team: while most processors will not provide the ARNs to us directly, we can assist you in contacting the proper department as well as with escalations.

Step 2: Provide Transaction Details

When requesting ARNs, be prepared to supply the following transaction details to help your processor identify and retrieve the correct records:

- Date and time of the transaction.

- Transaction amount.

- Customer’s name or card details (last four digits).

- Merchant ID (MID) or terminal ID, if applicable.

The more specific you are, the quicker your processor can locate the relevant ARNs.

Step 3: Access the ARNs

Once your processor has retrieved the ARNs, they will typically provide them in one of the following formats:

- A list or spreadsheet of ARNs and associated transaction details.

- Direct access to a reporting tool in the merchant dashboard, where ARNs can be viewed or exported.

Setting Up Rapid Dispute Resolution with ARNs

After obtaining ARNs, log into your Bankful merchant portal to input the information so our team can submit the information to the card network to integrate RDR into your transaction workflow.

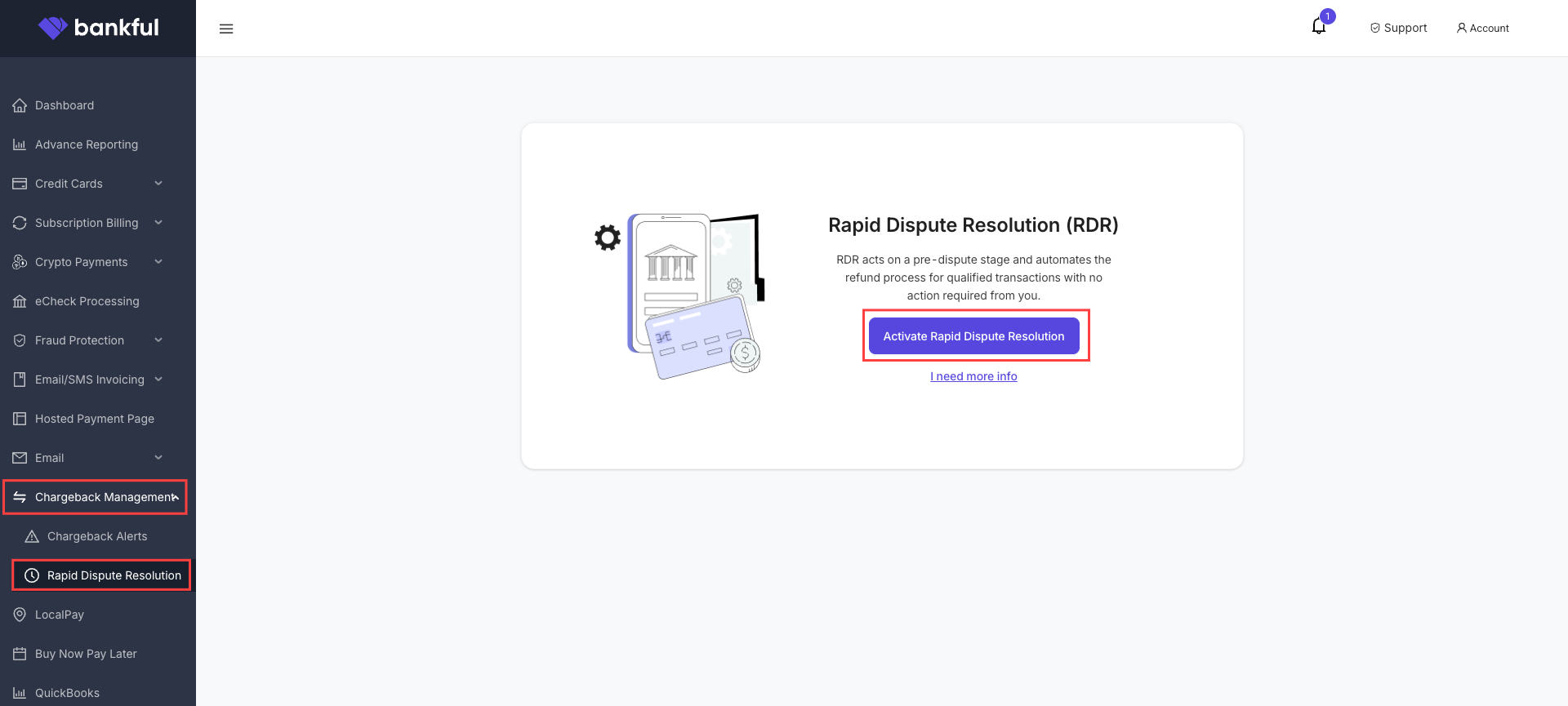

- Once in your Bankful portal, click “Chargeback Management” within the left sidebar and then “Rapid Dispute Resolution.” When the activation modal appears, click “Activate Rapid Dispute Resolution.”

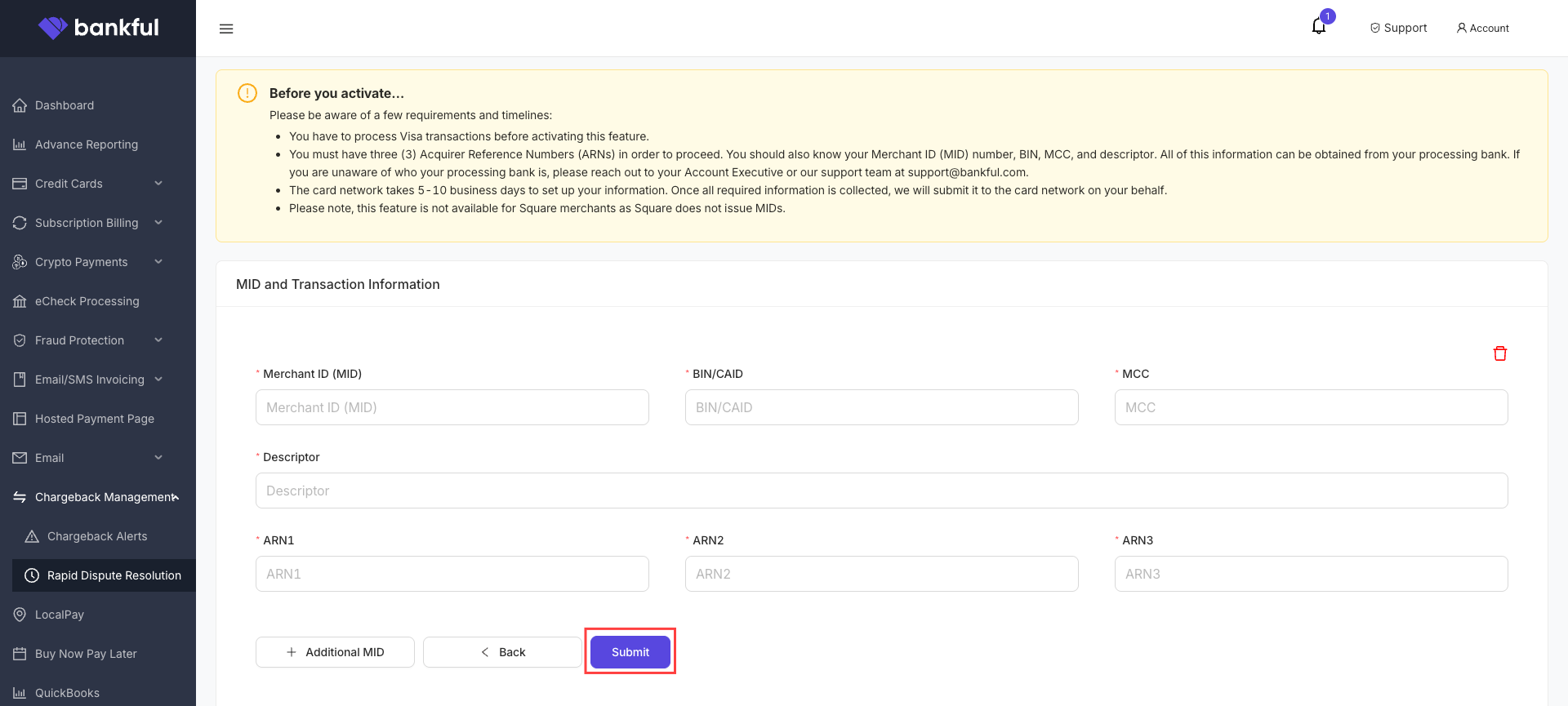

- Click “+ Merchant ID (MID).”

- Populate the fields with the information provided from your processing bank and click “Submit.”

- You will see a confirmation of your submission. Our Support Team will be in touch once the card network completes the service setup.

If you have any additional questions or need assistance, please submit a support ticket to our Support Team through your portal.

01.24.2025