Fraud Shield in Shopify

Prevent Fraud, Prevent Chargebacks, and Increase Business

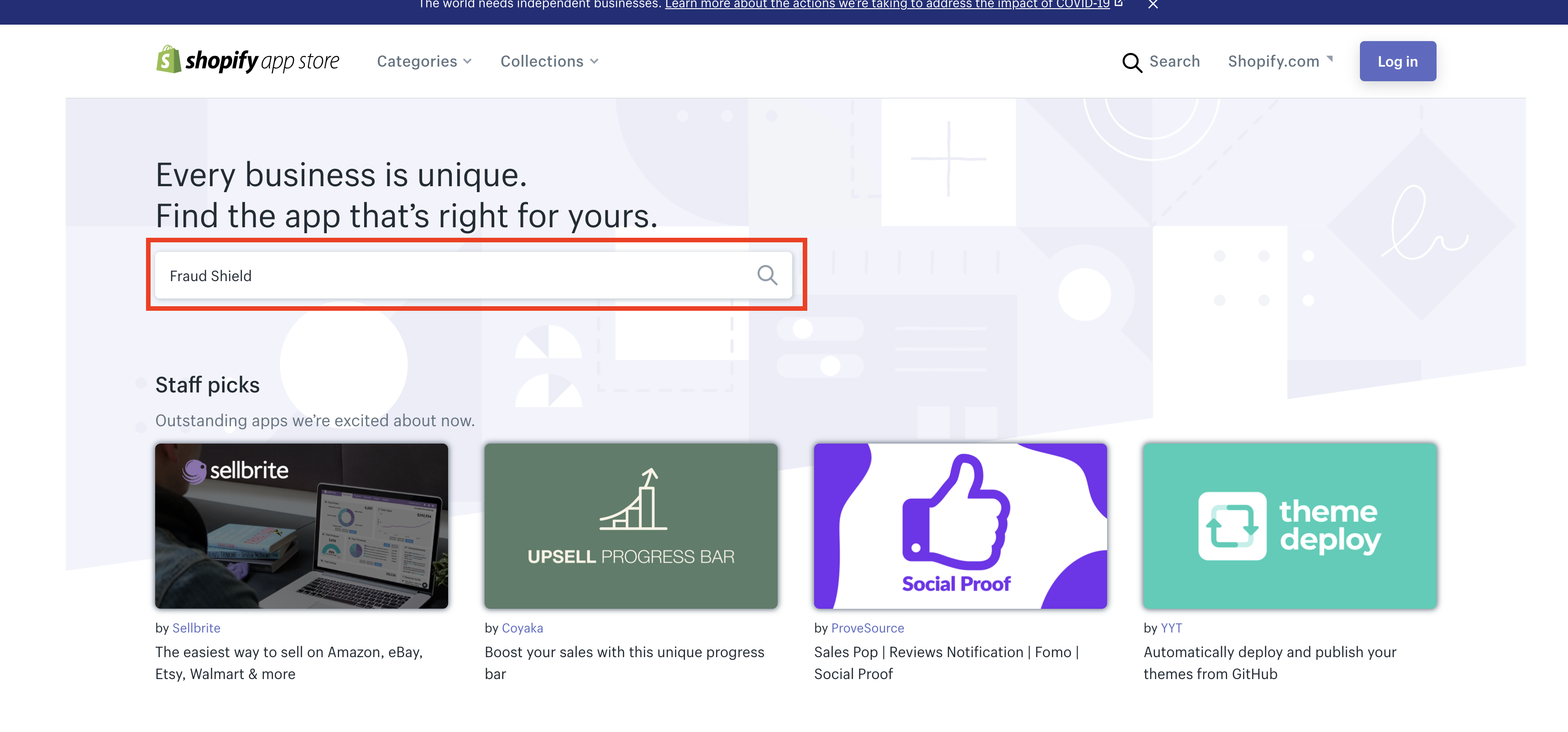

- We will want to start by logging into our Shopify admin portal.

- From here, we will want to move to the Shopify App Store.

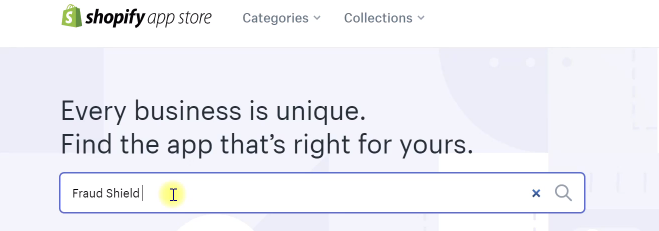

- We then want to search “Fraud Shield” in the search bar.

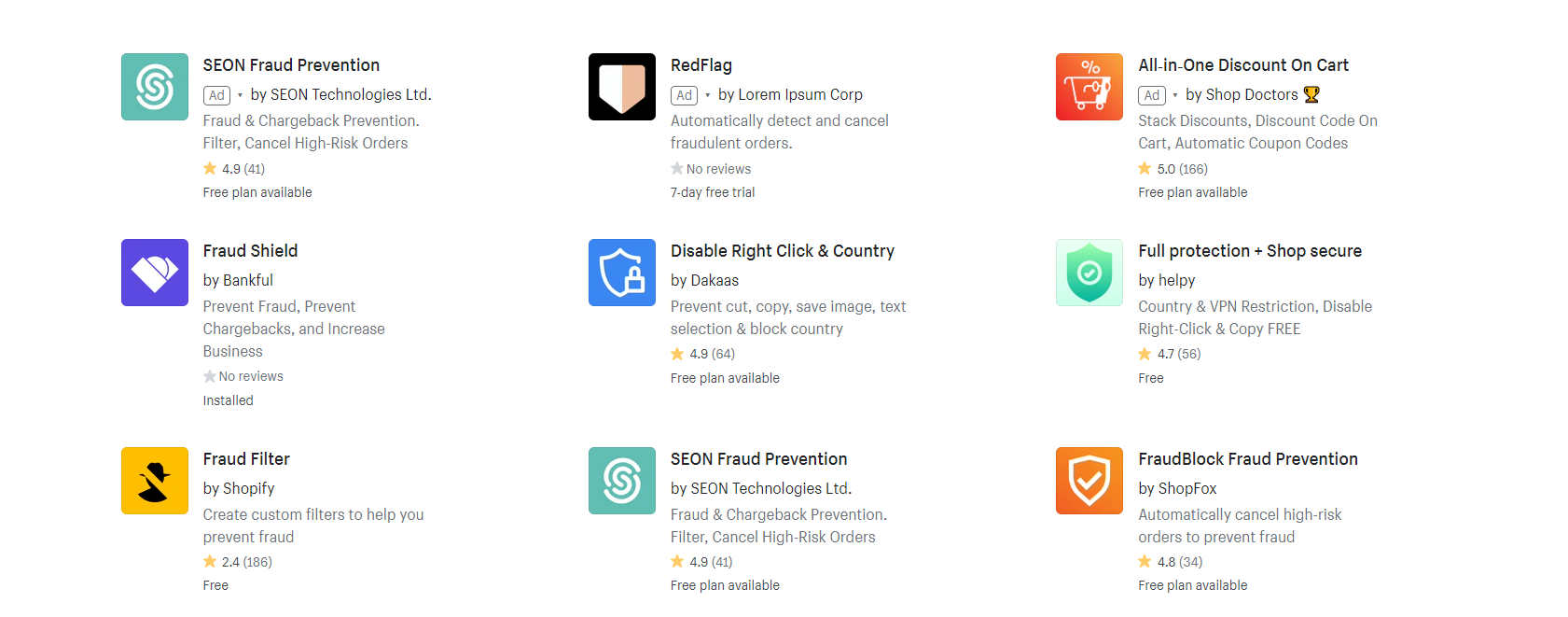

- In the results, we will want to click on the “Fraud Shield” app.

- You will then be asked to add the app, so please click the blue “Add app” button.

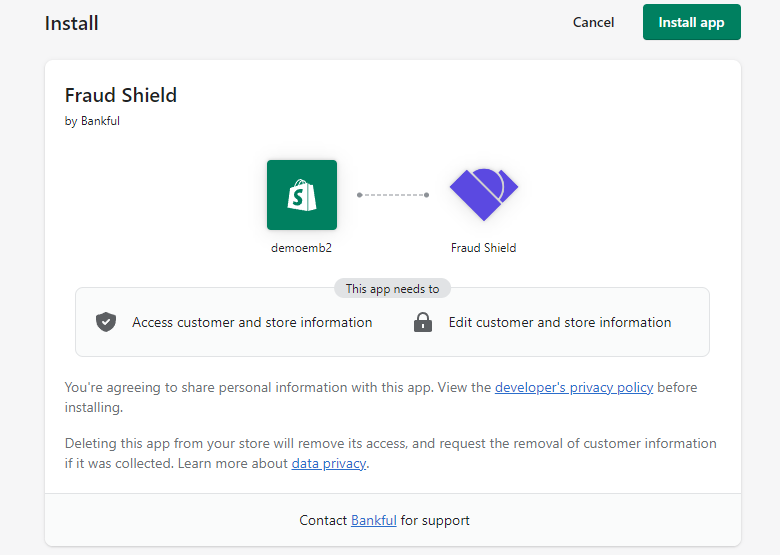

- We are now taken to a page verifying that we want to install the “Fraud Shield” app. Please click “Install app”.

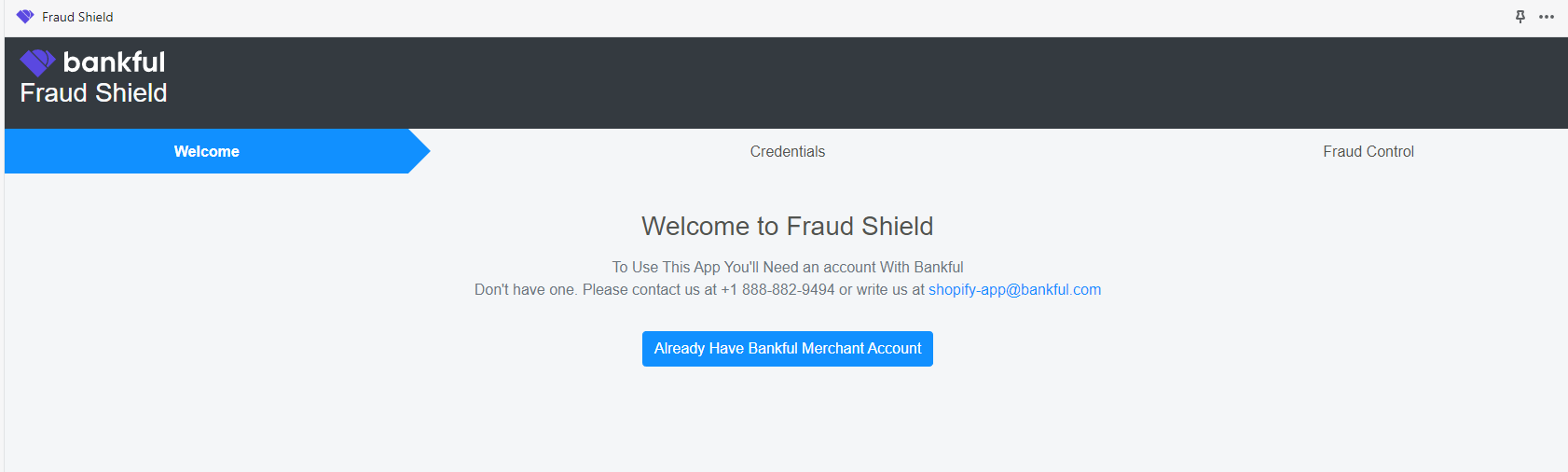

- You will now be asked if you have a Bankful account. Please click “Already Have Bankful Merchant Account”.

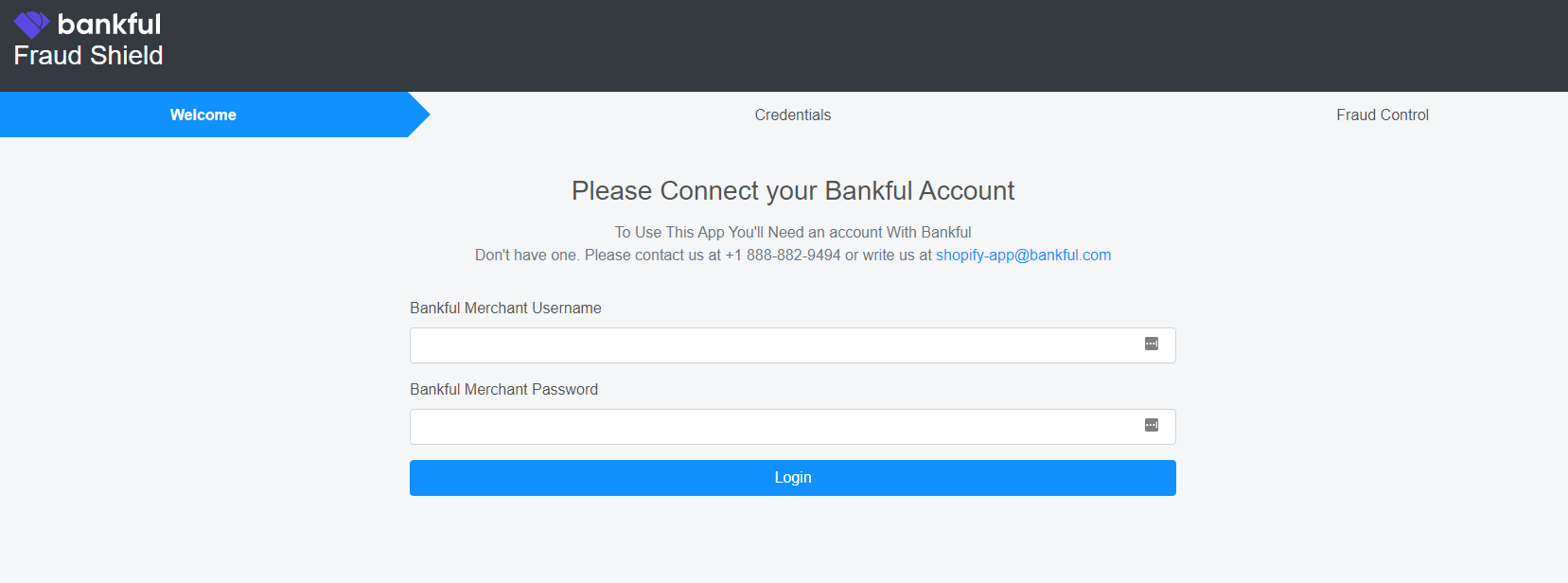

- Next, we will be taken to the credentials page where you must enter your Bankful username and password and click “Login”

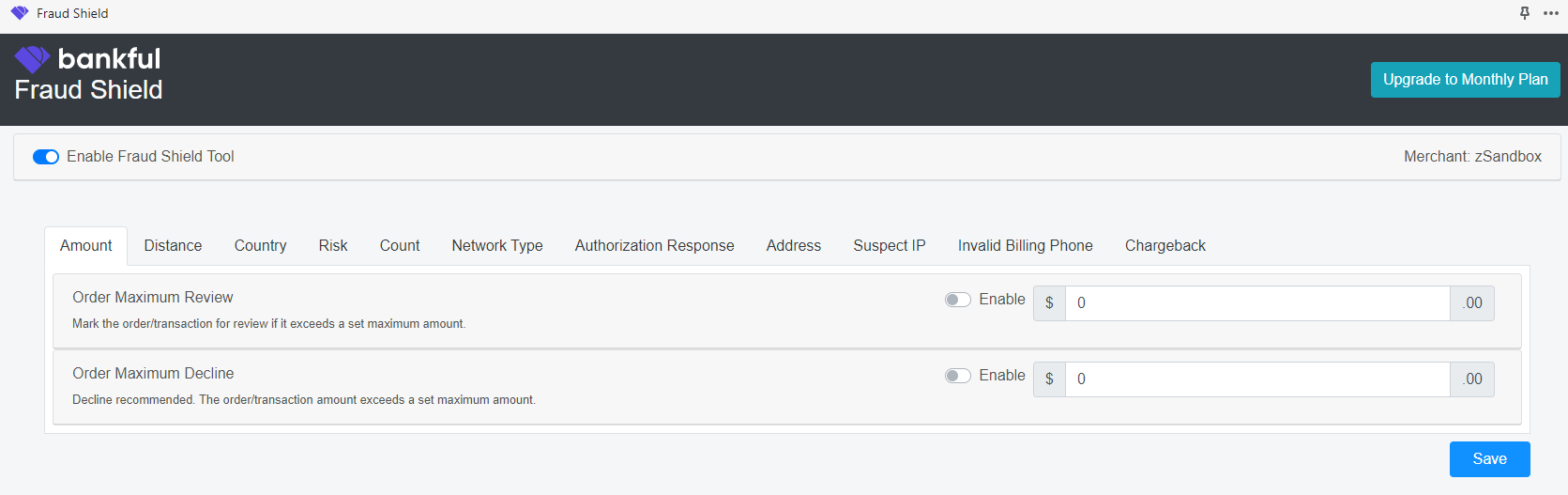

- You will now be at the configuration page, meaning you have successfully installed the “Fraud Shield” app.

Advanced AI

Trained to recognize patterns that have not been seen before, Bankful AI detects sophisticated, complex & automated fraud in milliseconds.

Fraud Solution

Fast payments and complete fraud prevention – in one combined solution. Simple user interface designed with the merchant in mind.

Order Linking

Sophisticated feature engineering & dynamic models running simultaneously allow Bankful to identify features that are for payments.

Fast Payments & Complete Fraud Solution All in One

Performance Metrics

Bankful utilizes a vast network, that was built over 12 years of experience from 6,500 merchants across multiple industries and billions of transactions fed into models that quickly identify different types of fraud.

How Bankful Works

Bankful’s device collector API creates a unique digital persona that triggers real-time analytics to detect and stop fraud. Simple user interface designed with the merchant in mind.

Bankful’s Advanced AI Delivers Desired Business Outcomes

Bankful’s AI detects new and emerging payment fraud attacks before merchants are hit with chargebacks. It enables an instant response at the speed of digital business.

The Fraud Shield product provides no guarantee against fraud, or other unauthorized activity nor the prevention of resulting chargebacks, and/or payment network fees. All applicable fees for use of the product and for any transactions apply. While assistance is available via email or articles, the merchant is ultimately responsible for enabling and configuring the product and its filters, rules, and/or settings to determine how the product will assess transactions. The merchant is solely responsible for assessing the risk of its transactions and implementing any risk management controls that are reasonably necessary to prevent unauthorized activity. The final responsibility for accepting or rejecting a transaction will remain with the merchant.